Stef, a 13-year-old online gamer and skateboarder, joined Bank Zero in Aug 2022. For the first time in his life Stef now had his own easy access to his account. No more asking his parents to log in to their banking App to view his account – finally he could see what money was flowing in and out right in real-time! All Stef had to do now, was to transfer his remaining money from his old account at his other bank, to his new Bank Zero account…

But, to Stef’s surprise, after viewing his other bank account for the first time in months on his mom’s login, he saw that there was a monthly R29 online card transaction which has been running for more than 6 months, and was depleting the already little money he had not yet spent. Being a teenager who loves thrift markets, that was a huge shock.

Stef has previously heard the adults talking about debit orders, and specifically complaining about the horror of being hit by unauthorised rogue debit orders, and he always counted himself lucky that he didn’t have to play in that grown-up game yet. But he never really understood that a regular transaction running automatically against his card (aka card subscriptions), is actually not different from those debit orders. What a shock to his world.

What was this monthly subscription that was coming off his card? Stef couldn’t remember where or when he signed up for this in-game subscription. And now he didn’t know how to stop it without calling some call centre, apparently having to fill in forms and then also having to pay some admin fee. Stef angrily grumbled that that was just way too much admin, and that he’d rather spend the time learning his new skateboard trick, a ‘tre flip’.

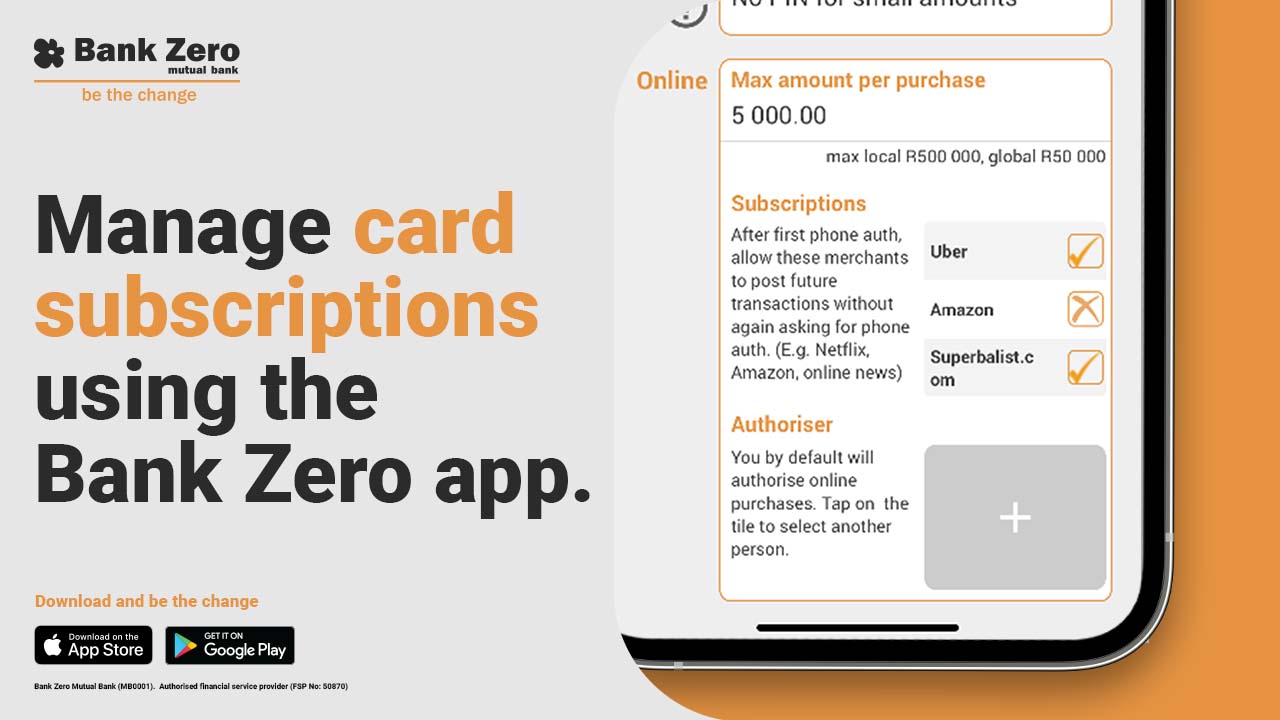

With Bank Zero, there’s definitely an easier way. And with Zero admin. When Stef first sets up any new card subscription (and even while being totally engrossed in an online game) he will be asked to personally approve the notification appearing on his phone. But whether he approves it or not, he then has the option to tick that supplier for future auto-approval (or auto-decline) in his Card Settings menu. No tick, no unauthorised card transaction.

Bank Zero checks EVERY month if those middle-of-the-night card subscriptions should still be allowed. Because Stef should technically be asleep, and because he did tick the name of that supplier, the transaction will go through.

And what’s even more awesome is, if Stef wants to stop this from running in future (like he would’ve wanted to do with his R29 card debit order at his previous bank), he just logs into his Bank Zero App and unticks that supplier from his card subscriptions list – and Bank Zero will then decline that card subscription / debit order on his behalf. No paperwork, no call centres, no loss of money.

This really cool innovation and control of card subscriptions has made Stef realise that “banking with Bank Zero is sic and not just for Boomers”. In fact, he thinks all his friends should be with Bank Zero as well, because with Bank Zero handling all this admin for them, they can now really concentrate on ‘tre flips’, not to mention their ‘Call of Duty’. In fact, all their parents should join too, so that they can stop being grumpy.

As Lloyd Moran announced to all in a tweet in end 2021, after joining Bank Zero and discovering Bank Zero’s card subscriptions innovation: “It’s amazing that this isn’t offered by the other banks. Great work guys!” Not only is this a cool innovation – it’s also unique in the world currently. Although all banks request approval for online card transactions on secure sites. no other bank currently requests approval for those regular monthly online card subscriptions / debit orders, nor for unsecure (often overseas) sites. And they definitely do not build a personalised list of all your card subscriptions.

Welcome to popups plugin

Welcome to popups plugin