Despite doing 100-fold more transactions through Bank Zero over eight months than through its other big bank account, Lemon+Lime deli paid only R112 in Bank Zero fees – compared to R8,936 at the big bank.

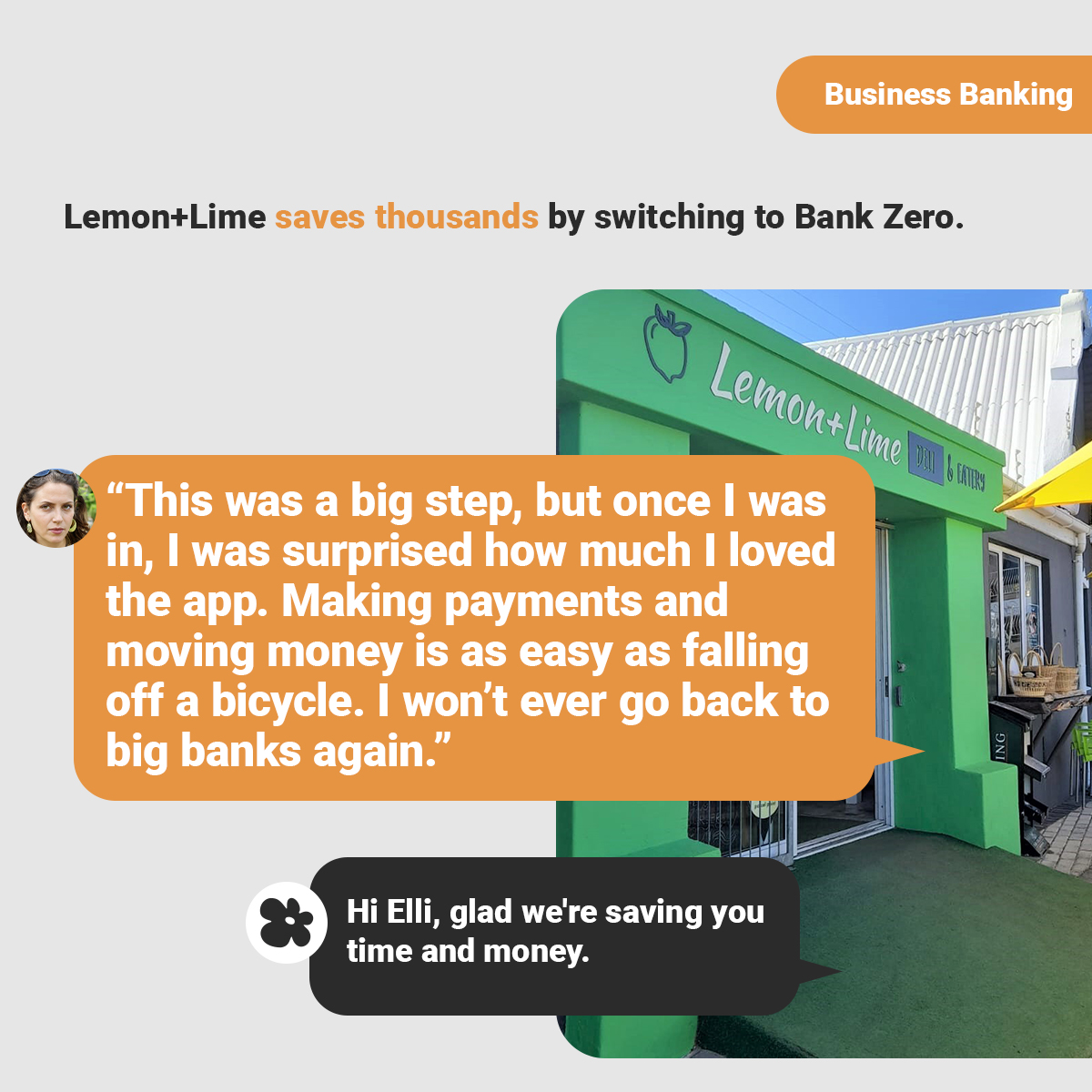

As you drive from Cape Town, hugging the coastline all the way to Hermanus, you’ll pass one of the best delis in South Africa.

Nestled in Pringle Bay between the mountains and the sea, you’ll find freshly baked goods, special local and imported meats and cheeses, and the best coffees – all at a great price.

This deli is called Lemon+Lime and is owned and managed by Elli Wessels.

Not only are her baked goods exquisite, but they are produced mostly on-site by women from the surrounding community whom she has worked with closely over the years.

Her focus is on delighting all of her customers – no matter whether they are visitors or locals.

Choosing the right bank

Since Elli started Lemon+Lime a few years ago, she has been carefully watching every cent that flows in and out of her business.

She became keen to try the new banks that promise no/low fees, but was concerned that she wouldn’t be able to do all her banking using just an app as she describes herself as “not a digital person at all”.

However, she was finally convinced by one of her customers to try out Bank Zero, and opened her account 8 months ago.

“This was a big step, but once I was in, I was surprised how much I loved the app. Making payments and moving money is as easy as falling off a bicycle,” said Elli.

When she first created her Bank Zero account, the ability to facilitate SARS payments was not yet available, so Elli had to keep her account with a big bank open for these payments in parallel to running her Bank Zero account.

This provided her with an excellent fee comparison between the two accounts – and Elli was stunned with just how much cheaper Bank Zero was than the big bank.

She was doing 100-fold more transactions through Bank Zero than through the other big bank account – yet while she had paid R8,936 to the big bank just in bank fees, she paid just R112 to Bank Zero over that same 8-month period.

Now that Bank Zero can facilitate SARS payments, (“It works like a dream”, she said), Elli will be closing her big bank account.

This means that, during 2023, she will save at least R13,236 in bank charges, and this will compound in the years to come.

What’s more, customer card payments made using her 3rd party card machine arrive in her Bank Zero account the very next day, as opposed to 2 to 3 days with big banks.

This results in better cash flow, which any small business owner will know is of huge importance.

“I won’t ever go back to big banks again,” said Elli.

Welcome to popups plugin

Welcome to popups plugin