Monthly billing can be a nightmare – just ask any business owner or financial manager. Payments add up quickly to several hundred transactions.

The Bank Zero App removes clutter and shifts admin to staff (“your own bankers”). This way, long days of doing banking admin is gone. I smile a lot these days 😊.

Here’s a live snapshot of Bank Zero’s very own Office check account to which I have added an authorisation chain. 23 payments have been loaded and need approval or rejection. (The balance is R5.5m and the latest two transactions of a R4m deposit and a R0.2m transfer are shown.)

To setup an authorisation chain is easy – just go to the tile menu for that business account (3 dots) and select “ Authorisation Chain”.

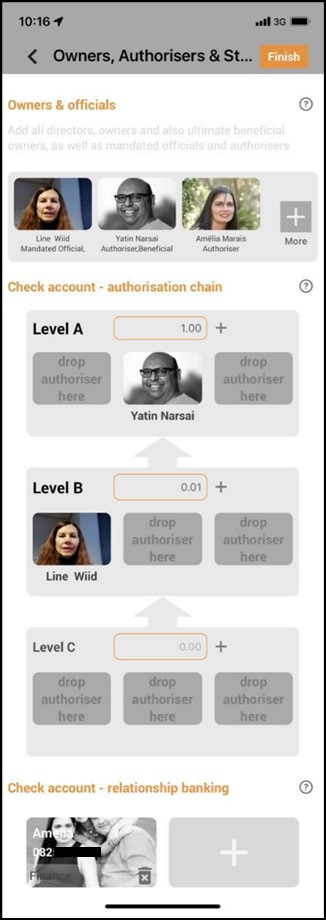

Here’s how we set up our own authorisation chain for this specific account:

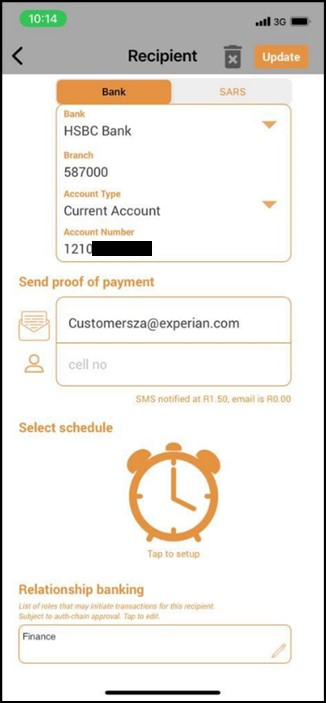

Amelia, our financial manager, has been loaded as a relationship banker with a “Finance” role.

Amelia, our financial manager, has been loaded as a relationship banker with a “Finance” role.

As CFO, I simply drag from the “Owners & Officials” list and drop them as authorisers onto the relevant level. I then also choose the threshold amount.

If additional people are needed as authorisers, I simply tap the “+ more” on the right.

Here’s what I’ve done:

- All payments are loaded by Amelia, the relationship banker

- I approve payments above R0.01 – level B

- All payments (except for those between R0.01 and R0.99) must also be approved by Yatin – level A

You can do up to 3 authorisers per level. Any of the 3 can do the approval on that level – not all.

And, up to 3 levels can be used – we only use 2 on this account. Large businesses can stratify their approvals where the “big peanuts” approve large payments and the others do the rest.

Threshold amounts determine the level. It can start above R0.00 meaning that any payment loaded can be immediately approved if it’s below the first threshold. Petty cash hassles are gone – control spend by what’s available in the account 😊.

(You can also set up this relationship banking via Account Settings, by tapping the account name on the tile.)

It‘s typically a mission to change mandates and delegation of authorities, increase profile limits, change daily limits, increase transaction limits, or activate an additional banking channel or service. I can do all of this easily on my Bank Zero App.

Previously, when I used traditional banks, I had to go into a branch while dragging along the owners to present themselves physically. Furthermore, I had to provide original wet ink signatures on all the pages and pages of documents. Imagine my frustration when owners are scattered across the country or even the globe!

How Amelia (my relationship banker) supports me

Amelia can add recipients and change their details. If it’s an existing recipient (from before I loaded Amelia as a relationship banker) I just grant her access. Here’s an example:

The bottom section (Relationship banking) is where I select the roles that may pay and edit this specific recipient.

The bottom section (Relationship banking) is where I select the roles that may pay and edit this specific recipient.

Because Amelia belongs to the “Finance” role, she sees this recipient when loading payments.

Scheduled payments can only be loaded by me. Kapish?

Here’s what’s really cool: I can add another relationship banker, and by using that same “Finance” role, this new relationship banker immediately sees the relevant recipients.

So, Amelia can quickly be swapped to another person if needed, using the same role.

Roles stay, but people come and go!

This is how I authorise

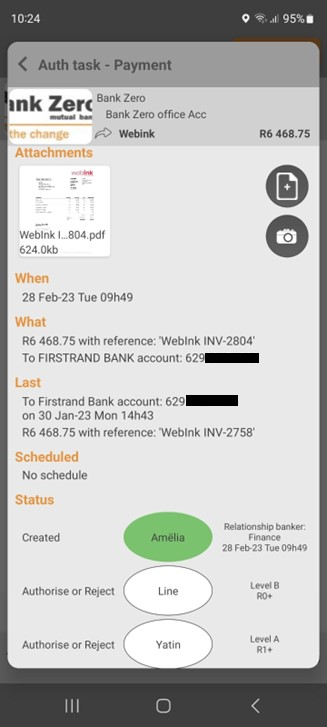

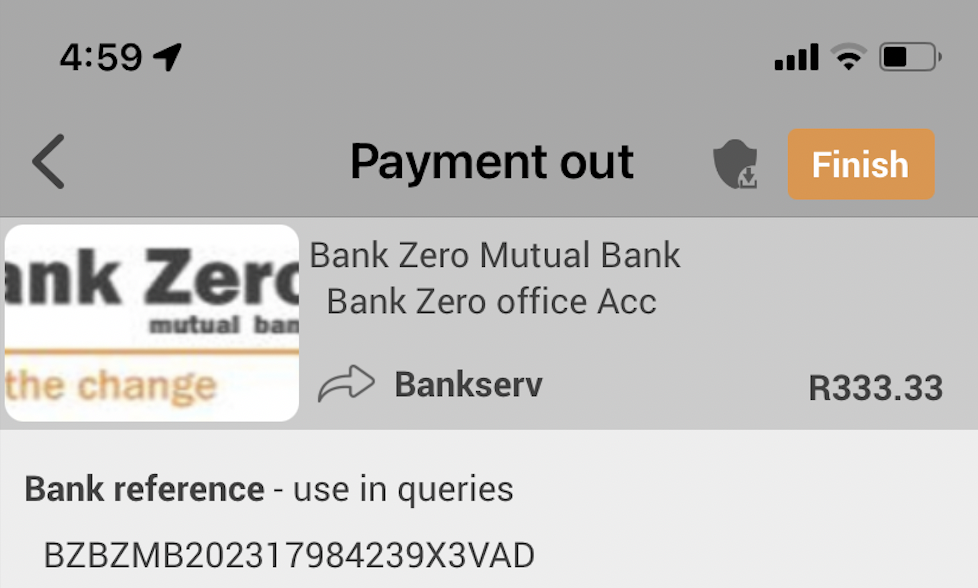

When I tap the tile bubble (like the “23” bubble shown earlier) I get a list of the loaded payments. I can tap any payment to access all the details:

I insist that all payments have their signed invoices attached. (This makes auditing and tracking much easier!)

I can tap any of the attached documents to view more info. I can also immediately check bank account details and more.

These documents are stored with the payment and can also be accessed from inside the account history, at any point in time.

Danger! Payments in red mean recipient details were changed – both the current and previous bank are displayed, so that I can check. (I’ve learnt the hard way that criminals steal like this.)

For completeness I can also see if any scheduled payments are active on this recipient. No more duplicate payments!

Also, the authorisation chain status is shown, with Amelia doing the load, with Yatin and I still to approve. (Note to self: our iOS dev team needs accounting standards training!! They insist on showing the authorisation chain in the wrong sequence…)

Making payments – some funky features

The Bank Zero ecosystem brings me safety and peace of mind when paying bills.

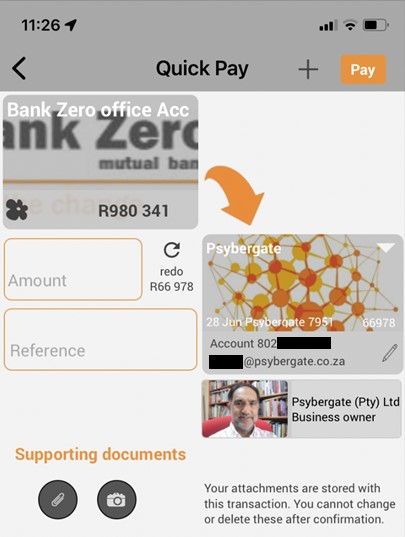

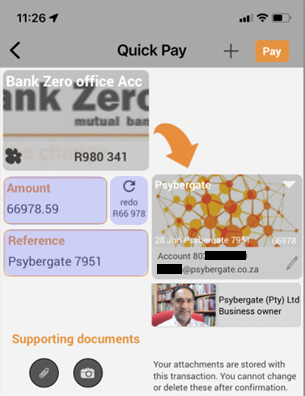

No more hoping that I’m paying the correct recipient. I can easily see who I’m paying. The company logo and the owner is displayed on the app. When I’m paying individuals, I can see their photo.

And then another big time saver on top of the photo display, is the redo function. I simply tap on it to make a payment, and all the fields are populated. If needed I can change any of the details, such as the amount or reference. (Often an invoice changes just in the last few digits.)

When one starts using the App you realise it is much easier and quicker to do your banking now, in comparison to the old internet /online banking. One’s phone is always with you and it has effectively become another limb. With online banking you must first switch on your laptop, log on to internet banking, find the correct tab in all the clutter, and then do what you need to do.

On the App you find creative and innovative ways to set up your banking accounts and canvas to make your life easier and the business more efficient. It is literally like a painting on a blank canvas. Each person’s will look different, best suited for their own needs.

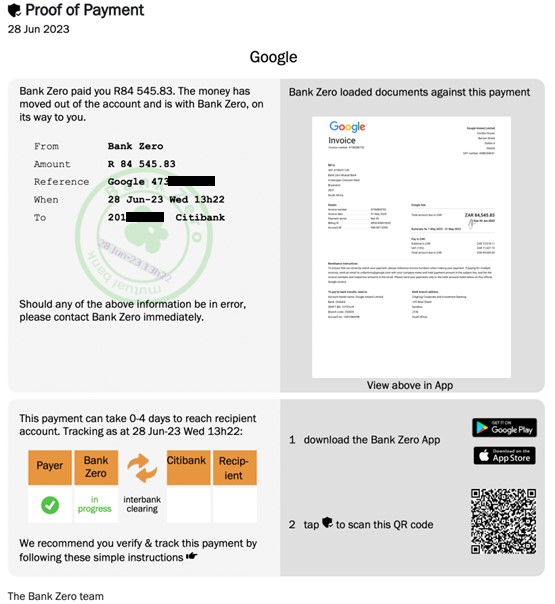

Proof of payments have become a critical document over the years. Have a look at Bank Zero’s.

It shows all the usual information, but importantly it also includes the supporting documentation you have attached to the transaction, making it easier for the recipient to identify the credit on their bank account.

It shows all the usual information, but importantly it also includes the supporting documentation you have attached to the transaction, making it easier for the recipient to identify the credit on their bank account.

And for you as the payer it shows who, what, when and how much you have paid.

It also makes it much easier when the auditors come along to do the annual audit – with all the documents relating to the transaction in one place.

Proof of payments are automatically emailed to the mandated official. However if you can’t find it – no problem – just tap on the transaction and the details of the transaction are then displayed. and then tap on the shield icon and it is emailed to you again (at no cost).

Welcome to popups plugin

Welcome to popups plugin